News of a sharp decline in bicycle imports in the European bicycle market has emerged. According to data from the European Union’s statistics agency, the import volume of electric bicycles decreased by 15.58% year-on-year from January to July, especially in the entry-level and mid-range markets, which were most affected by the economic recession in Europe. Meanwhile, Shimano’s third-quarter sales report revealed a year-on-year net sales decrease of 24.8%, totaling 1.8 billion euros, and operating income dropped by 48.8% to 350 million euros. This trend has persisted for most of 2023, indicating Shimano’s prolonged decline.

From a data perspective, the bicycle industry’s development is gradually declining compared to the past. The market dividends formed in the early stages are gradually disappearing. The import volume of bicycles in Europe surged by 30% last year, with an even larger increase in the average import amount. The inventory gap was significantly replenished in 2022, resulting in manufacturers being stuck with high inventory levels, and the market entered a short-term adjustment period. The momentum of the EU’s import surge this year was halted due to excessive inventory. However, there is no need to worry excessively. Despite the current market downturn, growth momentum and demand still exist. Additionally, high-value products remain robust in the current market, maintaining a positive development trend.

High Demand as a Long-term Trend

Shimano believes that the high demand for bicycles is a long-term trend. Although the market growth is currently restricted by inventory, the demand will persist in the long term. Once the inventory adjustments in North America and the European markets are completed, the supply and demand balance in the bicycle industry will be restored.

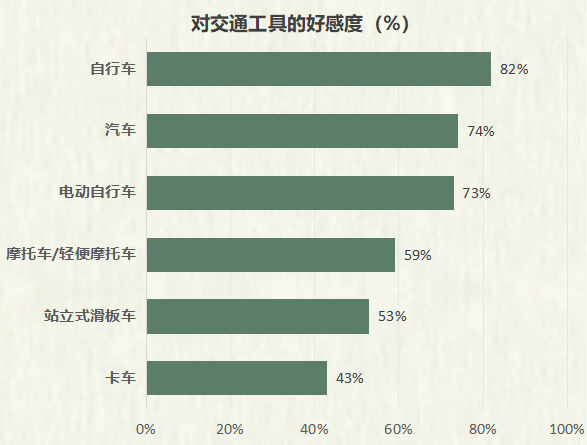

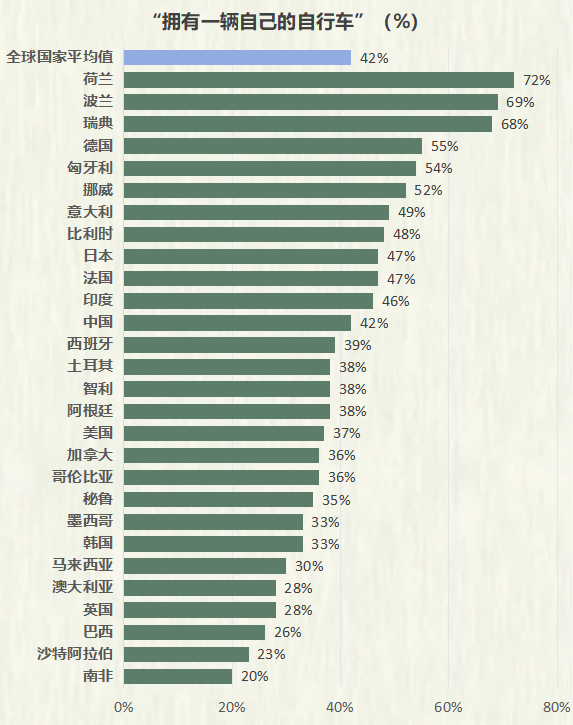

According to Ipsos’ online survey data, nearly 82% of the global population has a strong preference for bicycles, and 73% for electric bicycles. Short-distance commuting tools have become the preferred mode of travel for many people. Currently, the global average bicycle ownership rate is only 42%, indicating that the market still has significant room for growth. Moreover, in most regions, the penetration rate of electric bicycles is less than half, indicating that there is untapped market demand.

Bullish Outlook for the High-end Market

While the overall bicycle sales are gradually declining, forecasting agencies suggest that this trend might continue until next year. However, considering the growth in the value of imported products in Europe and the export trends of certain countries, the high-end market is still performing well. In the first and second quarters of this year, the European Union’s electric bicycle market saw a reduction in import volume but reached an import value of 500 million euros. This reflects the increased circulation of high-value products in the market.

The main export countries of high-end bicycles are less affected by environmental factors. For example, Germany’s electric bicycle exports grew by 14% in the first quarter of 2023. Taiwan, China’s bicycle exports showed a decrease in quantity and an increase in price in the first half of the year, with the average export unit price rising to $1,655, a year-on-year increase of about 13%. Additionally, countries like the Netherlands, France, and Spain have even seen an increase in export volume, proving that high-end bicycle models still have continuous shipping capabilities. On the other hand, exports of mid-to-low-end products, represented by Cambodia, have suffered a severe setback, with exports in the first half of the year decreasing by 30.52% year-on-year, and the decline continues to widen.

The popularity of road bikes in the Chinese market due to the enthusiasm for outdoor activities has also driven strong sales, maintaining appropriate levels of inventory for outdoor vehicles.

Furthermore, the economic downturn has tightened everyone’s spending, making consumer spending more cautious. Shimano stated, “In Asia, Oceania, and Central and South America, although people’s overall interest in bicycles is strong, due to economic uncertainty, the retail sales of complete bicycles are still somewhat sluggish.” Once the economy improves, the pent-up consumer demand may bring a slight increase to the travel market.