In the bicycle industry, with the development of information technology and shifts in consumer purchasing behaviors, businesses are poised for another transformation in their relationships with dealers. Brands are beginning to integrate the vertical market through Direct-to-Consumer (D2C) models or direct acquisitions, gradually gaining control over retail channels and propelling bicycle business operations into a new era.

Rick Vosper’s depiction outlines roughly three modes of retail evolution in the bicycle industry:

Bike 1.0, around 1950 to 1975, witnessed a dominance of the specialized retail market by the sole brand Schwinn, creating a relatively stable era in terms of suppliers and retailers.

Bike 2.0, post the cycling craze and the introduction of mountain bikes in the early 21st century. This period was affected by complete competition, with no specific brand accumulating enough market share or competitive advantage to control the market.

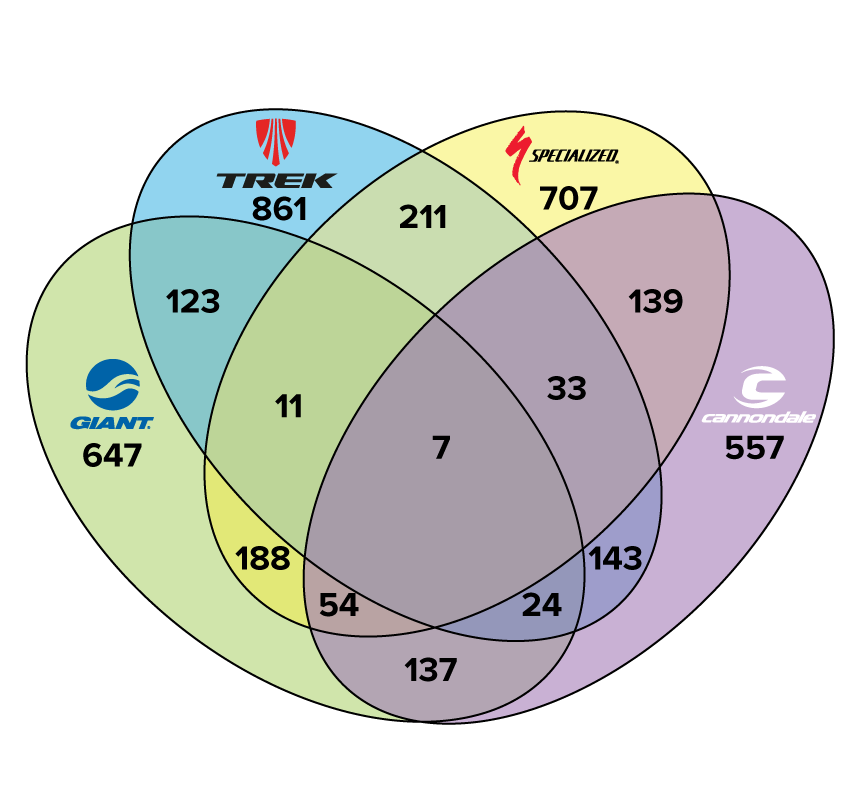

Bike 3.0 saw the emergence of leading brands such as Trek, Specialized, Giant, and Pon dominating the market. Brands expanded their scale by establishing strategic alliances with selected dealers. However, this approach eventually failed as most large dealers opted to collaborate with multiple brands. By 2020, nearly 30% of Quadrumvirate dealers held two or more top-tier brands.

However, in recent years, bicycle brands have gradually begun to sell directly to consumers or entirely bypass dealerships, using dealers solely as fulfillment mechanisms, marking the typical characteristic of the Bike 4.0 era.

Trek pioneered this concept in 2015, while Specialized and Giant publicly termed this new customer-centric, open market as an “ecosystem,” replacing traditional sales channels with an all-channel sales “ecosystem.” To strengthen control over sales channels, brands have begun directly acquiring key bicycle stores in important markets, vertically integrating retail channels, most notably seen in the increase of flagship brand-owned stores.

Expansion of flagship brand-owned stores continues

In August 2021, Dutch company Pon Bike Holdings acquired Mike’s Bikes, a chain of 11 stores in Northern California. Two months later, Pon announced plans to acquire Dorel Sports Group, merging it with its brand series, eventually forming a global enterprise with sales nearing $3 billion.

Trek has been consistently acquiring bicycle stores for years and currently owns an estimated several hundred retail stores, while Specialized is also following suit. Through acquisitions of major market retail stores, brands are integrating key segments of the professional retail channel to increase sales, achieve economies of scale, and improve market efficiency.

Giant has repeatedly declared its intention to exit retail operations for Click-and-Collect (C&C) sales. Giant’s President, John Thompson, mentioned in March ’22, “We’re not engaging in the ownership game of retail. We’ve determined that the best route to consumers is through capable, vibrant (LBS) retailers.”

Directly owned store sales accounting for over 10%

Why do brands emphasize self-owned store layouts? Primarily, it allows them to encroach on the offline footprint of other brands. In ’21, Trek acquired 21 stores in Orlando, Florida, many of which were previously Specialized dealerships. Trek’s procurement in retail business directly weakens Specialized’s distribution channels.

Simultaneously, these stores can create distinctive offline marketing styles, elevate service standards, and, importantly, boost sales, economies of scale, and market efficiency. Dealer roles are being replaced, and brand profits are rising.

Statistically, Trek and Specialized brand-owned stores currently account for over a tenth of all bicycle store sales. Among these, Trek holds the highest number of directly owned bicycle stores, making it the largest brand bicycle chain store in American history.

The integration of vertical channels highlights significant changes in operational methods. However, brands utilizing the Direct-to-Consumer (DTC) model wield strong control over the supply chain. Given the demand for rapid responses to market changes, most successful DTC brand suppliers require flexible and rapid, adaptable production capabilities. Hence, successful DTC brands are mostly medium to large-scale enterprises within the industry. Acquiring dealerships is also a high-risk gamble suitable only for the financially strongest brands.

However, this presents an opportunity for smaller brands. Once major manufacturers establish their own direct sequences in retail layouts, large bicycle manufacturers may no longer require as many dealerships. They may opt to reduce the number of dealerships in specific markets, potentially affecting small dealers of major brands. However, the reduction of dealership numbers by top-tier brands could present a significant opportunity for expansion in the markets of second and third-tier brands.