Against the backdrop of “carbon neutrality,” the global electrification of two-wheeled transportation is accelerating. Electric bicycles and electric scooters, among other two-wheeled products, continue to gain popularity, becoming iconic means of short-distance travel. At the same time, electrification reforms are sweeping through more markets, gradually making global electric mobility a reality.

In 2023, the electric two-wheeler market continues to maintain stable growth. The demand for personal mobility devices has shifted from avoiding close contact to pursuing eco-friendly and healthy travel options. The sustained rise in market demand has attracted numerous manufacturers, driving product technology upgrades and intensifying market competition. However, the sudden surge in market size has also led to several product safety incidents. As governments pay more attention to this, regulations are tightening to standardize industry development, ushering the market into an orderly growth phase. So, what does the future hold for the electric two-wheeler industry in terms of market size, changing competitive dynamics, and future product trends? We have compiled a comprehensive global electric two-wheeler market data and report for you.

- Market Size and Growth Trends

According to data from Boston Consulting Group, as of May 2022, the global micro-mobility market primarily consisting of electric two-wheelers has reached a size of nearly 100 billion euros, with a projected compound annual growth rate (CAGR) exceeding 30% over the next decade. This market size in the hundred-billion range positions it as a hot sector for both the present and future, with strong demand providing substantial growth potential.

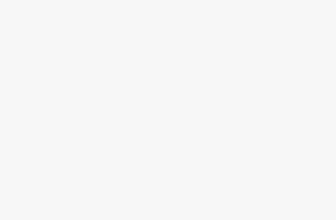

As per research firm MarketsandMarkets, by the end of 2022, the global electric bicycle (E-bike) market had reached $49.2 billion in size, with a total shipment of 51.25 million units. Among various types of electric mobility products, electric bicycles (E-bikes) that offer greater practicality are preferred by consumers.

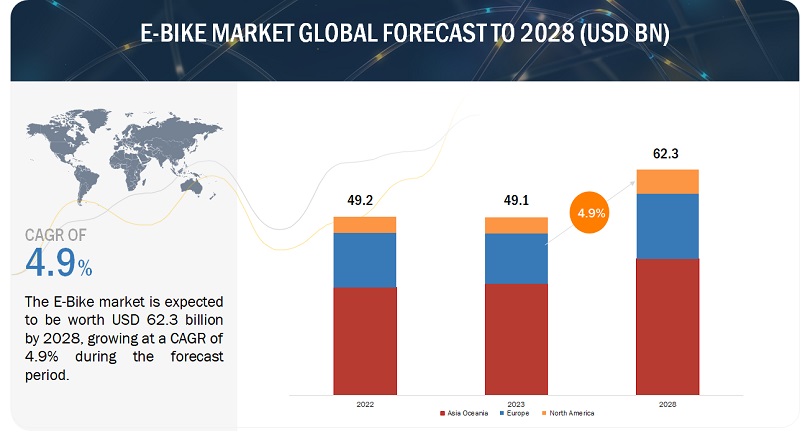

Additionally, the global electric scooter market has been steadily growing. According to a study by Grand View Research, Inc., in 2021, the global electric scooter market witnessed a 48.3% year-on-year increase in sales, reaching 6.351 million units. The global electric scooter market is projected to reach $12.26 billion, with a compound annual growth rate of 13.7% from 2023 to 2030.

Under the wave of global electrification, more economical electric motorcycles are gaining popularity in regions like Southeast Asia and Africa. A recent report by “Powering Renewable Energy” predicts that the motorcycle market in sub-Saharan Africa will grow to $5.07 billion by 2027, with electric motorcycles becoming a dominant product in the sustainable transportation transformation in the region.

- Expansion of the Two-Wheeled Electric Market

In 2023, the global electric two-wheeler market is experiencing a slowdown in growth rate, but it still maintains an overall upward trend. The electric two-wheeler market, led by Europe and North America, is expanding, and the electrification revolution is reaching Southeast Asia and Africa. The development logic and stages of the two-wheeler market differ in regions such as Europe, North America, Southeast Asia, and India. In Europe and North America, where bicycle culture is strong, pedal-assist bicycles are preferred. In contrast, Southeast Asia, constrained by infrastructure and economic factors, still relies heavily on long-range, cost-effective gasoline motorcycles. However, with the introduction of favorable policies and changing consumer demands, Southeast Asian markets are gradually adopting electric trends.

Europe: From January to July 2023, the European Union imported a total of 2.3142 million bicycles, with a total value of 505 million euros, an increase of nearly 7.59% compared to the same period in 2022. Russia is the largest market for electric scooters in Europe, with sales increasing by 43% year-on-year in the first quarter, reaching 245,000 units. Most residents view electric scooters as economic alternatives to taxis, car-sharing, and private cars, with 85% of purchased vehicles being electric scooters and only 10% being electric bicycles.

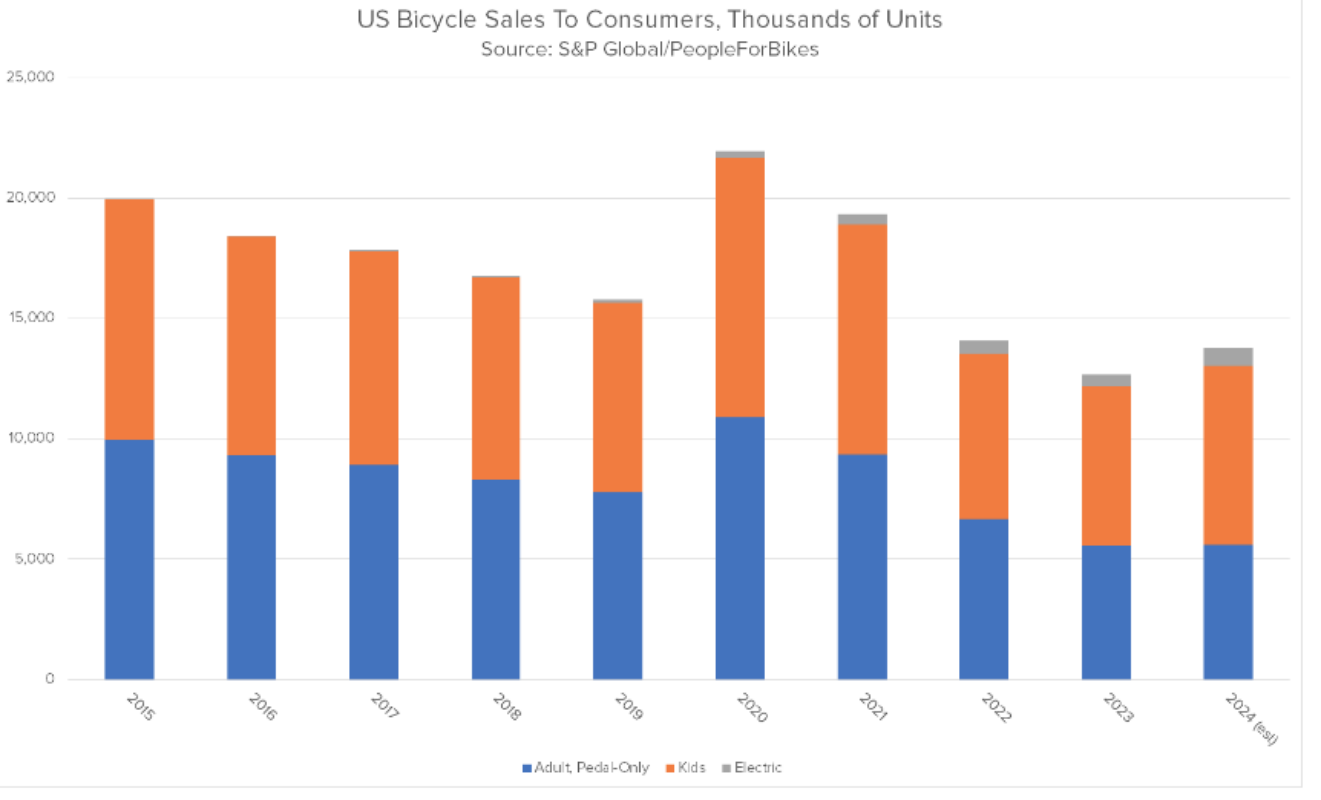

United States: Electric bicycle sales in the United States have been consistently rising, with a nearly 200% increase from 2019 to 2021. Statistic predicts that the North American electric bicycle market will reach $4.1 billion by 2028. In 2023, the U.S. electric bicycle market reportedly exceeded one million units for the first time, with a growth rate of 25%.

However, compared to the traditional bicycle industry for sports and outdoor cycling, the market penetration rate for e-bikes in the United States still has significant room for growth.

Southeast Asia: Southeast Asia is the world’s third-largest two-wheeler market. According to data, in 2022, the motorcycle market in the ASEAN ten countries reached 10.6 million units. In the first six months of this year, motorcycle sales in Southeast Asia reached 7.5 million units, making it one of the fastest-growing regions globally. The large existing stock of motorcycles in these markets provides substantial room for market growth under electrification reform.

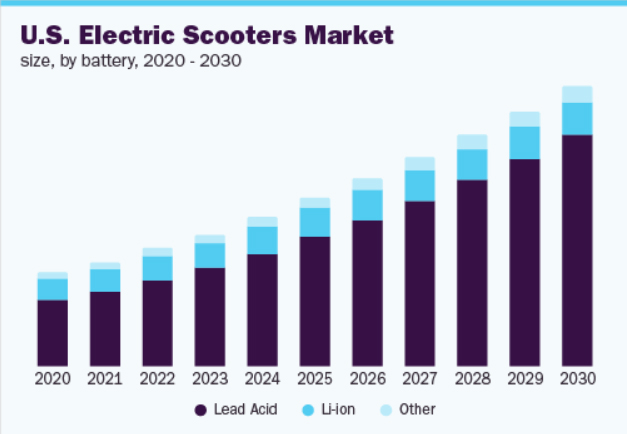

China: According to the latest data from the China Bicycle Association, electric bicycle sales reached 34 million units in 2021. Electric two-wheeler sales reached 49.75 million units in 2022, with cumulative sales of approximately 50 million units and a social stock of 350 million units. According to the China Motorcycle Association, electric motorcycle sales reached 7.6327 million units in 2022. With over 340 million electric two-wheelers in circulation in 2021, China ranks among the world’s leaders in the electric two-wheeler market.

- Changes in Global Production Patterns

Global two-wheeler production patterns are undergoing significant changes. While China used to dominate the global bicycle market, the rise of local production in Europe and increased attractiveness of the Southeast Asian market are reshaping global production patterns.

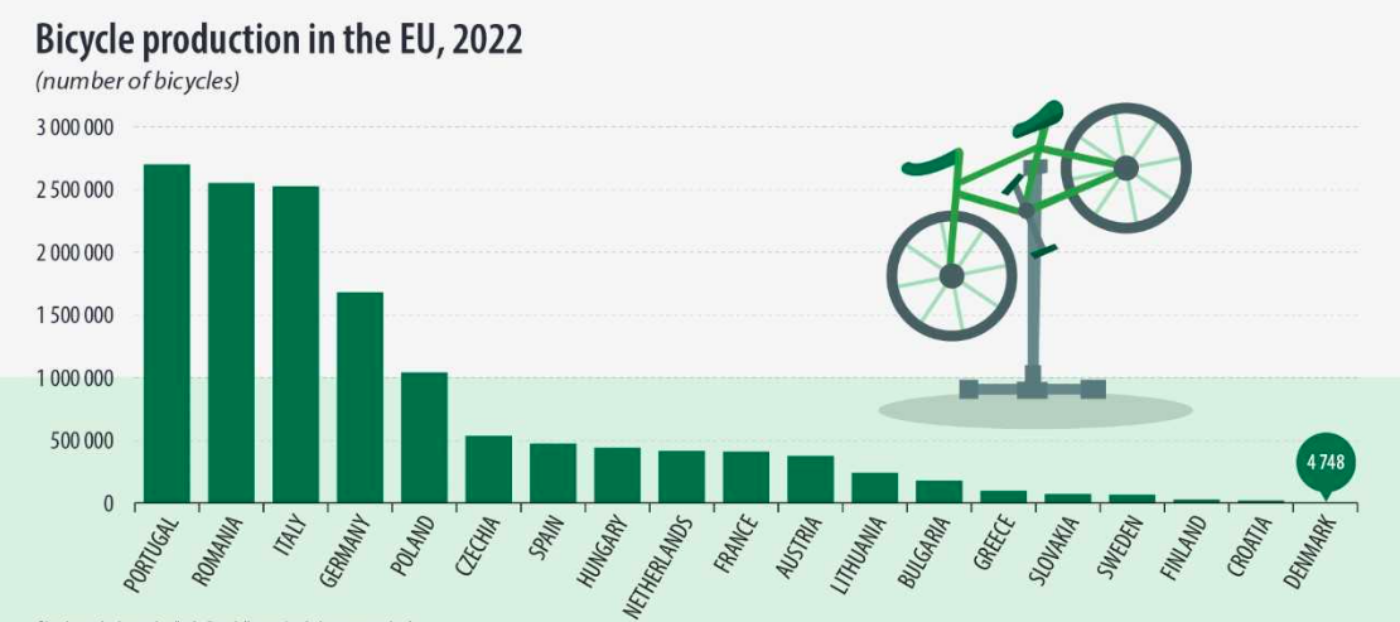

Europe has begun to encourage the development of its domestic bicycle industry, attracting external production reshoring. Additionally, Europe has imposed higher import barriers on bicycles and strengthened its capacity for domestic production and sales. Countries like Portugal, Romania, and Italy have seen growth in bicycle production. In recent years, the European Union has maintained an annual growth rate of over 10% in bicycle production, producing a total of 13.5 million bicycles in 2021, an 11% increase from 2020. Over the decade from 2012 to 2022, EU bicycle production increased by 29%, showing rapid growth over the last three years.

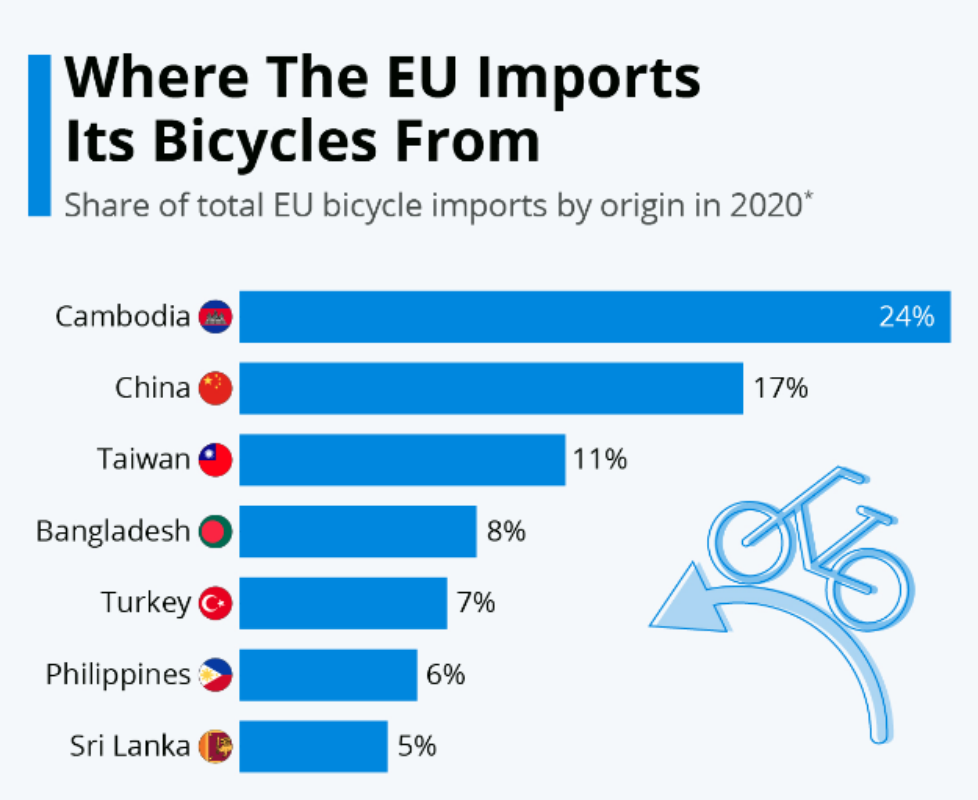

On the other hand, with the implementation of the Regional Comprehensive Economic Partnership (RCEP), Southeast Asia has become an increasingly attractive market. For example, Cambodia’s bicycle exports exceeded $700 million in the first nine months of 2022, a 104% year-on-year increase, making it a major bicycle supplier to the European Union. Cambodia’s status in the global bicycle trade has risen, and Southeast Asia is gradually taking over low-end bicycle production from China.

According to data from the China Bicycle Association, China produced 763.97 million bicycles in 2021, a 1.5% year-on-year increase. The bicycle industry in China is expected to maintain steady growth, with bicycle production expected to reach 784.65 million units in 2023.

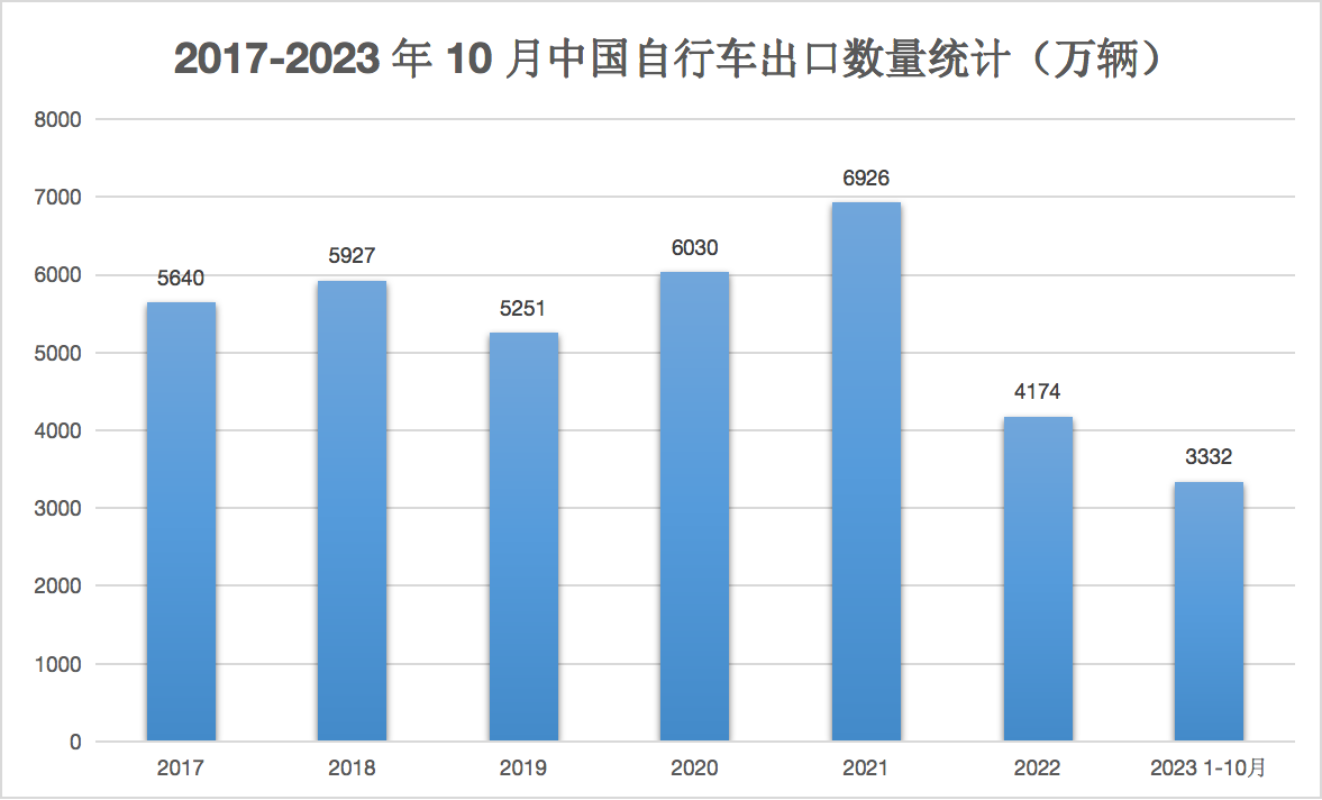

According to Chinese customs data, from January to October 2023, China exported 33.32 million bicycles, with an export value of $2.199 billion. Among them, the total export volume of electric bicycles in 2022 was 16.1661 million units, with a total export value of $5.336 billion.

Looking at Chinese bicycle export data from 2017 to October 2023, export quantities and values peaked in 2021 and have since declined. Nevertheless, China remains the world’s largest bicycle producer.

The global two-wheeler production landscape is changing, challenging China’s leading position. The rise of European and Southeast Asian markets is redistributing global bicycle production shares.

- Intensifying Market Competition

With an increasing number of players entering the market, the industry is facing situations of declining post-demand momentum and high inventories in 2023. Leading companies have also reported bankruptcies and acquisitions. For instance, VanMoof, a well-known Dutch E-bike brand that had attracted nearly $200 million in investments in just two years and had over 200,000 users globally, declared bankruptcy in August 2023 and was reportedly acquired by the McLaren subsidiary Lavoie for an estimated “tens of millions of dollars.”

The entire electric two-wheeler market has entered a period of fluctuation and adjustment. Unlike the high investments and market prosperity of previous years, the focus in recent times has been on bankruptcies, closures, and financial difficulties. Some regions have seen shrinking market demand due to policy influences, dealers facing funding shortages, and high market concentration leading to increased competition. Manufacturers that entered the market early have witnessed rapid changes in the industry, from a time when products were easily sold as long as they were available in 2020, to a situation in 2021 where products could sell well with good cost control and product homogenization, and now in 2023, manufacturers need to think more about building competitive advantages. These advantages encompass various aspects, including cycling culture, localized and international brands, and product homogenization.

- Development of Scenario-Based and Intelligent Features

The production of key components for two-wheeled products is concentrated among a few leading manufacturers. Various hardware configurations have gradually converged due to technological developments, further narrowing the differentiation space. Therefore, designing products based on consumer demands has become increasingly important.

From the “last mile” to distances exceeding 10 kilometers, from commuting and daily travel to sports and entertainment, users’ scenarios for two-wheeled products are becoming more diverse, driving the development of diversified products. The positioning of electric two-wheelers has also evolved beyond simple means of transportation to becoming symbols of leisure, interests, sports, and even fashionable lifestyles. This trend reflects consumers’ diverse demands for products, including intelligence, convenience, and smoothness.

In addition to performance requirements such as range, battery, and power, intelligent features and personalized demands in various scenarios have become critical factors in consumers’ purchase decisions. Intelligent features such as safety and anti-theft measures, vehicle condition monitoring, and smart charging are particularly favored by young and high-end consumers. Vehicle intelligence in the future will not only be about vehicle safety and convenience but will also encompass interactive, social, and full-scenario services and experiences throughout the entire travel process.

- Characteristics and Preferences of Consumer Segments

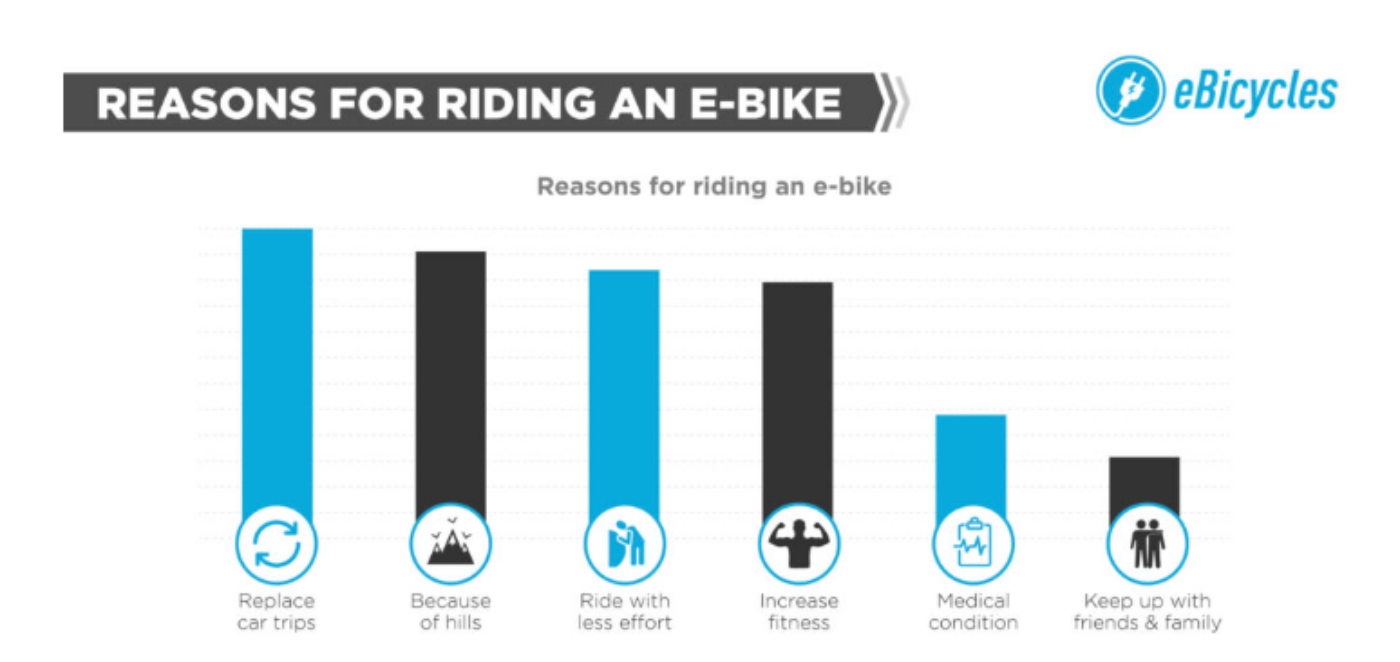

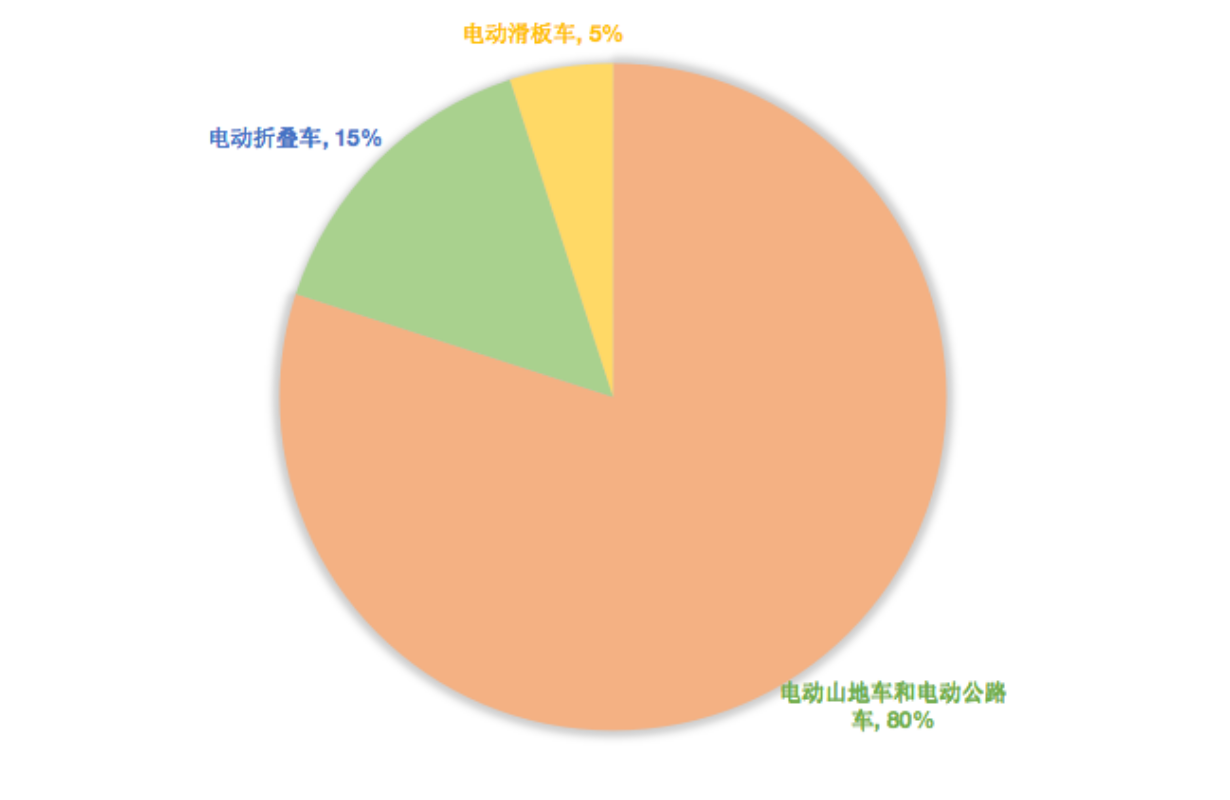

The characteristics, needs, and behaviors of different consumer segments reflect varying product preferences. According to data from Global Info Research, the global electric bicycle product segments mainly include electric mountain bikes, electric road bikes, electric folding bikes, and electric scooters. Electric mountain bikes and electric road bikes dominate the market, accounting for 80% of the market share. Electric folding bikes, known for their portability, suitable for short trips, make up about 15% of the market share. Electric scooters are a relatively new product with features like lightness and simplicity, suitable for urban short trips and commuting, and they hold approximately 10% of the market share.

Age is also a key differentiating factor in product selection among consumer segments. Teenagers and young adults often prioritize product fashionability, design, and brand influence. They may lean towards products with vibrant colors, novel styles, and relatively high brand recognition.

Middle-aged individuals tend to consider practicality and cost-effectiveness when purchasing vehicles. They may focus on factors such as battery range, charger efficiency, and motor performance to ensure that the vehicle can provide reliable service and cost savings.

Elderly consumers may prioritize vehicle safety and ease of operation when making a purchase. They may be concerned about factors like braking systems, shock absorbers, and seat comfort to ensure safe and comfortable rides.

There are also more specific consumer segments. For example, housewives may prioritize the functionality and convenience of vehicles when making a purchase. They may focus on factors such as basket size, vehicle weight, and battery life to facilitate daily shopping and household tasks.

According to Varla Scooter’s user statistics, the male-to-female ratio among purchasers is as high as 76.83%, with the majority of users falling between the ages of 25 and 44. This indicates that electric scooters’ primary target audience consists of economically capable professional scooter enthusiasts and long-distance commuters.

Price is also a crucial consideration for consumers. According to Maxfox Bike, 66.8% of respondents consider price as the primary factor when purchasing electric bicycles. Varla Scooter’s official website data shows that its three most popular products are priced at approximately $1,000 each, with 50.4% of participants considering low operating costs as an important factor in their purchase decisions.

Safety-oriented needs drive brand-oriented consumption. According to consumer research firm GfK’s forecast, safety demands will become a key factor influencing consumer behavior. As consumers increasingly focus on safety issues, brand-oriented consumption patterns will become more widespread. Large brands typically have stricter quality control standards and more robust supply chain management systems, providing consumers with more reliable product assurances. This trend is particularly evident among young people, who tend to choose brands with good reputations and high-quality guarantees.

- Growth in the Commercial Two-Wheeler Market

Apart from personal travel, the mature short-distance delivery service industry has experienced rapid growth in B2B demands such as instant delivery and cargo transport. As consumer structures gradually change, the commercial sector will become an important driver of market growth.

The development of e-commerce has opened up significant growth space for electric freight transport. Before the pandemic, 40% of deliveries in New York City were doorstep deliveries. Today, it has reached 80%. Since the New York City Department of Transportation initiated its commercial cargo bike pilot program in 2019, cargo bike travel in New York City has increased significantly. In 2022, cargo bikes traveled over 130,000 times, delivering over 5 million packages. Electric cargo transport products have become an efficient delivery method in the final mile logistics relay and have unparalleled advantages in reducing carbon emissions compared to other modes of transportation.

Food delivery is also seen as a potential blue ocean market. Due to the impact of the pandemic, the United States saw a significant increase in food and grocery deliveries. In August 2019, Americans spent $500 million on food and grocery deliveries, which rose to $2.5 billion in the first half of 2022. However, commercial electric bikes in Europe and the United States tend to be more expensive, and the concept of asset leasing is more mature. For example, for food delivery platforms, leasing allows them to flexibly adjust the number of delivery vehicles based on order demand and reduces the hefty expenses associated with purchasing and maintaining vehicles. It effectively addresses the last-mile micro-travel and micro-logistics pain points.

- Tightening of Local Regulations

In recent years, the electric bicycle market has entered a phase of rapid expansion, with a surge in the number of products. While this has made transportation more convenient, it has also led to an increase in safety incidents caused by electric bicycles. For example, in the United States, there have been frequent fire incidents caused by indoor charging, unauthorized modifications, and lithium battery failures.

To effectively eliminate safety hazards associated with such products, New York City announced a ban on the sale of electric bicycles with batteries that do not meet UL standards, raising the market entry threshold. Shared mobility products in France have also faced regulatory limitations due to safety incidents. In 2022, electric scooter accidents in Paris resulted in three deaths and 459 injuries. The increasing number of accidents has raised serious doubts among the public about the safety of electric scooters, leading to their ban on September 1, 2022. Additionally, event organizers have warned participants that if the behavior of electric bicycles does not improve, they will be added to the list of prohibited items. Moreover, some university campuses have started to ban electric bicycles and electric scooters, and local regulations on electric two-wheel products have been tightened in various regions.

For the electric bicycle industry, the strengthening of regulations means higher production standards and stricter market entry requirements, promoting market standardization. For consumers, it means purchasing higher-quality products and services. However, due to increased production and sales costs, consumers may also face price increases.

In 2023, the development of the electric two-wheeler market entered a stable phase, with slowing global market demand. However, in the long term, overseas bicycle demand remains relatively stable, and the electrification reform is expanding to more markets and products, leading to continued market and consumer demand growth. After the end of the dividend period, manufacturers are starting to explore and meet consumer demands from multiple dimensions. Increased market competition is driving product technology upgrades. In addition, the improvement of regulations in various regions will promote the industry’s development towards sustainability.