The implementation of “oil-to-electric” policies in Southeast Asia is fueling a massive surge in demand for electric two-wheelers.

Since 2019, countries in Southeast Asia, led by Indonesia, Thailand, and Vietnam, have enacted policies to address carbon emissions and environmental pollution by restricting the use of traditional fuel-powered motorcycles. By 2023, these Southeast Asian nations have introduced purchase subsidies for electric two-wheelers, accelerating the “oil-to-electric” transition. As a result, the demand for electric two-wheelers in the Southeast Asian market continues to soar, gradually replacing gasoline-powered motorcycles with electric scooters, e-bikes, and electric motorcycles. Southeast Asia has emerged as yet another vital growth market in the electric two-wheeler sector.

High Demand for Two-Wheelers in Southeast Asia

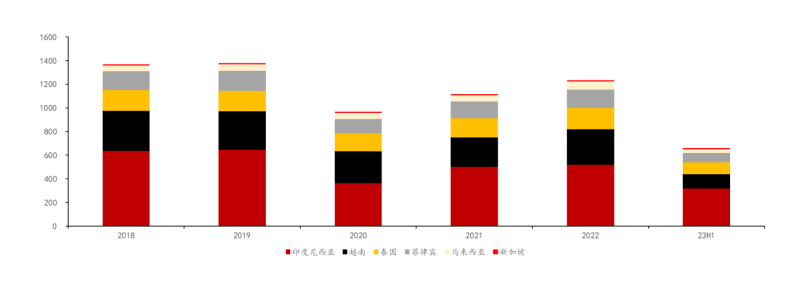

Southeast Asia stands as the world’s third-largest two-wheeler market. According to statistics, the motorcycle market in ASEAN countries reached 10.6 million units in 2022, ranking third globally. In the first six months of this year alone, motorcycle sales in Southeast Asia reached 7.5 million units, marking one of the fastest-growing regions globally. As of 2022, the number of motorcycles in Southeast Asia has reached a staggering 200 million, with Indonesia possessing 70 million units, Vietnam over 45 million units, and Thailand over 30 million units.

Continued increases in fuel prices due to the energy crisis resulting from the Russia-Ukraine conflict have seen Southeast Asian gasoline prices rise by 33%-45% in Q1 2023 compared to Q1 2021. This notable increase in the operating cost of traditional gasoline motorcycles has prompted more consumers to consider shifting to electric two-wheelers. Southeast Asian governments are also keen to promote electrification to reduce dependence on imported fuels.

“Oil-to-electric” Policies Implemented: Starting from 2023, Southeast Asian countries have introduced subsidies for purchasing electric two-wheelers. The Philippines proposed tariff exemptions for importing electric motorcycles, e-bikes, and their components over the next five years. Indonesia and Thailand have also decided to provide subsidies equivalent to over 3,000 RMB per electric motorcycle.

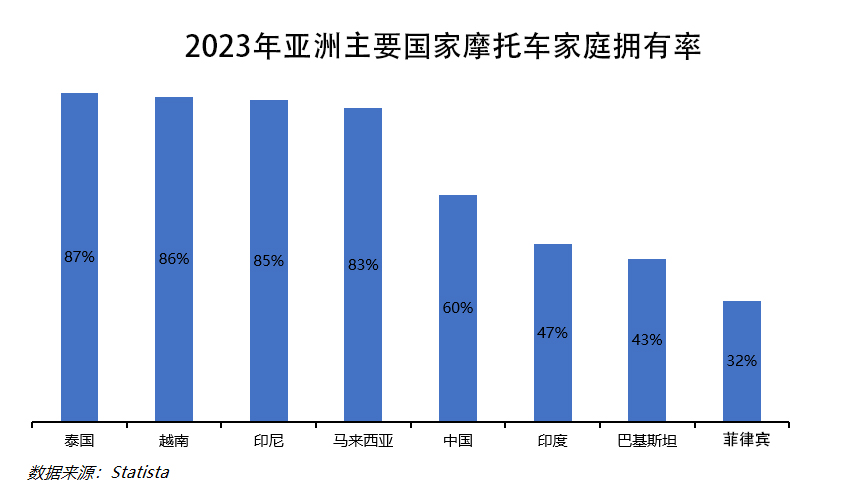

Southeast Asia features mountainous terrain, inadequate public transportation infrastructure, and urban commute distances typically ranging between 10-20 kilometers. Therefore, motorcycles have become the primary mode of transportation for many. In surveys measuring motorcycle ownership rates across major Asian countries, Southeast Asian nations like Thailand, Vietnam, and Indonesia lead significantly. The combination of high fuel prices and policy incentives is poised to release substantial demand for two-wheelers as gasoline motorcycles are phased out, making Southeast Asia a potential growth point in the electric two-wheeler market.

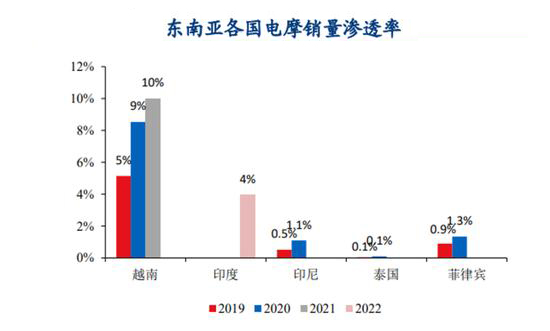

Low Electric Vehicle Penetration, High Market Potential

As of 2022, electric motorcycles hold less than a 1% share in the Southeast Asian market, signifying vast room for future growth. Vietnam has a slightly earlier adoption of electric motorcycles, with penetration rates exceeding 10%, while other countries remain below 5%.

Under the “oil-to-electric” policy rollout, Southeast Asia’s electric two-wheeler market is in its infancy but rapidly growing. Moreover, policy measures aimed at popularizing electric two-wheelers have attracted numerous companies to enter this space.

Market Penetration through B2B Collaborations

Beyond daily commuting needs, Southeast Asia’s delivery services, the sharing economy, and logistics are rapidly expanding. Many enterprises have tapped into a broader market by collaborating in the B2B sector. For instance, partnerships with delivery platforms introduce electric scooter leasing models or direct sales to these platforms.

Ride-hailing platforms like Grab and Gojek have launched their electric motorcycle fleets. Grab has partnered with Indonesian electric motorcycle brand Viar Motor and battery swap provider SWAP. SWAP’s electric scooter SMOOT Tempur caters to Grab’s motorcycle fleet needs. Gojek announced plans to fully electrify all cars and motorcycles on its platform by 2030. It has established collaborations with Indonesian electric motorcycle company Gesits, Taiwanese electric vehicle brand Gogoro, and Vietnamese electric vehicle enterprise Selex, providing drivers with electric motorcycles and electric cars.

The B2B demand for electric two-wheelers in Southeast Asia not only presents growth opportunities for brands but also significantly promotes the widespread adoption of electric two-wheelers across the region.

In conclusion, Southeast Asia’s electric two-wheeler market remains in its early stages, with a vast amount of untapped market demand. Currently dominated by Japanese brands in the motorcycle market, there is enormous potential for local brands in the electric motorcycle sector. The electrification of Southeast Asia’s two-wheeler segment is in its infancy, and Chinese companies, leveraging mature supply chains and comprehensive support systems, are well-positioned to capture more market share amid Southeast Asia’s “oil-to-electric” trend.