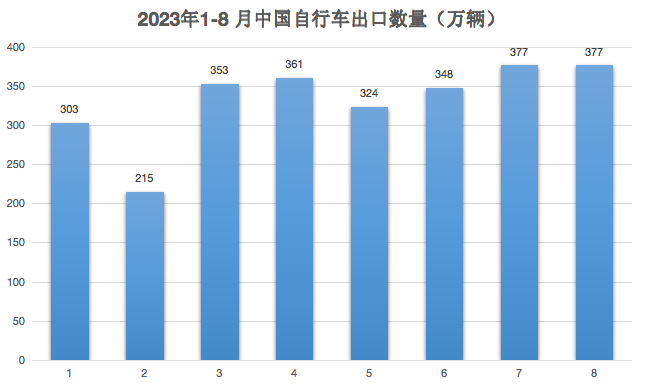

From January to August 2023, China exported a total of 26.32 million bicycles, marking a decrease of 4.91 million compared to the same period in 2022, indicating a 14.8% year-on-year decline. Since reaching a peak of 69.29 million bicycle exports in 2021, China’s bicycle exports have been declining due to broader environmental factors and constrained exports due to high inventory levels in Europe and the United States. However, it’s anticipated that China’s bicycle production in 2023 will reach around 100 million units, maintaining its status as the world’s largest producer and consumer of bicycles.

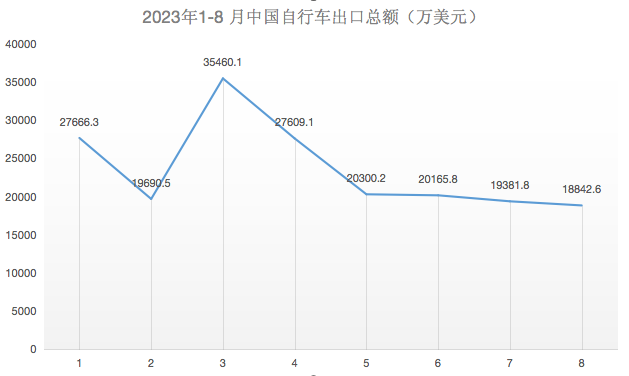

The export value of Chinese bicycles from January to August 2023 amounted to $1.83 billion, down by $850 million compared to the same period in 2022, reflecting a 30.4% year-on-year decrease. Despite the continued downward trend in the first half of the year, the rate of decline is gradually narrowing.

Challenges in Low to Mid-Range Bicycle Exports

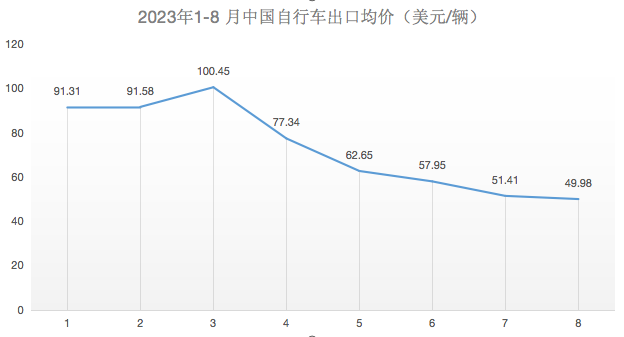

The average export price of bicycles from January to August 2023 was $69.57 per unit. In August, the average export price dropped to $49.98, nearly hitting the lowest point of the year. The average export price of Chinese bicycles has been on a consistent rise since 2016, climbing from $53.75 in 2016 to $89.15 in 2022, yet predominantly comprising exports of low to mid-range products.

However, the international market predominantly carries a surplus of low to mid-range bicycles. Consequently, Chinese exports are more significantly affected by global market conditions. Conversely, despite a significant drop in export volume in the first half of the year, Taiwan experienced a 20.35% increase in average export prices, driven by sustained shipments of high-end bicycles to Europe.

New Export Opportunities through the Belt and Road Initiative

Despite setbacks in exporting to European and American markets, Chinese bicycle manufacturers have observed considerable export growth to countries along the Belt and Road Initiative routes. According to the Chairman of the China Bicycle Association, exports to Uzbekistan, Tajikistan, and Georgia have doubled this year, with double-digit export growth to Indonesia, Thailand, and Turkey, maintaining robust momentum. The anticipated annual growth rate is projected to remain around 20%.

The China Bicycle Association also released a statement urging Chinese bicycle companies to focus on increasing exports to emerging markets in Belt and Road Initiative countries and the Regional Comprehensive Economic Partnership member nations, considering the decline in global bicycle shipment volumes.

Research and Development Upgrades: Intelligent Expansion

To secure a strong position in the international market, the Chinese bicycle industry has embarked on a path of research and development upgrades and intelligent development.

In 2022, Chinese bicycle enterprises allocated 1.85% of their main business income to research and development, intensifying innovative investments. This resulted in a 30% increase in domestic sales of mid to high-end sports bicycles. Simultaneously, manufacturers are emphasizing the intelligence of electric bicycles, incorporating features like voice interaction, smart unlocking, scene control, and assisted riding, making intelligent products accessible to a wider consumer base. Leveraging smart technology, manufacturers are steering towards exporting high-value-added products in the electric and smart bicycle domains.