In Europe, along with the trendy electric bikes and stylish e-scooters, there’s a growing presence of cargo bikes with retro designs and larger capacities seen on the streets.

Once overshadowed by cars in the 20th century, cargo bikes have made a spectacular comeback, especially with the integration of electric power, positioning themselves as excellent alternatives to automobiles. According to research from the CycleLogistics project in the European Union, over 50% of urban freight transport in Europe can be replaced by cargo bikes, which, when compared in terms of cost, efficiency, and load capacity, present numerous advantages.

Insights report that the global cargo bike market in 2022 was valued at $1.2814 billion and is projected to reach $2.04 billion in 2023, with a continuous upward trend at a compound annual growth rate of 14.36%. Europe accounts for nearly half of this market share, with Germany emerging as the most promising cargo bike market in Europe due to its exceedingly high market growth rate.

Large Market Size and Rapid Growth

The German cargo bike market boasts a large scale, with Germany ranking among the top three in terms of population in Europe. In a 2021 German cargobike market survey, nearly 12% of respondents expressed willingness to purchase a cargo bike. Extrapolating from the population aged 14 to 69 residing in Germany, there are an estimated 7 million potential cargo bike buyers.

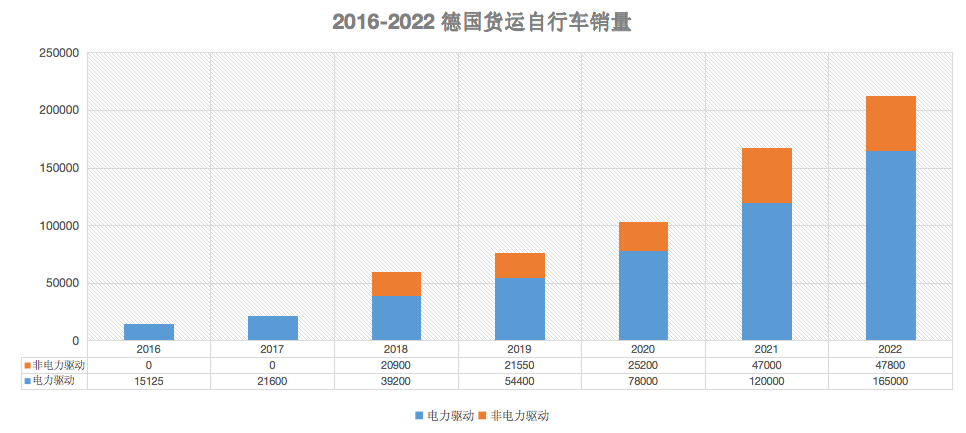

Moreover, Germany’s market growth rate far outpaces that of other European countries. From approximately 15,000 units in 2016, German cargo bike sales surged to about 212,800 units by 2022, averaging an annual growth rate of over 60% over seven years, making it one of the fastest-growing categories in the German bike industry.

The year 2018 saw the largest sales growth rate at 178%, while 2021 marked the highest increase in sales with over 60,000 additional units sold. In 2022, sales peaked at a total of 212,800 units, translating to nearly $600 million USD in market size for German cargo bikes, and the market continues to show growth.

Major Markets for European Cargo Bike Brands

According to the 2021 German cargobike market survey data, almost half of the cargo bike brands in Europe consider Germany their primary market, followed by countries like Denmark, the UK, and the Netherlands. Germany is deemed the most critical market in Europe.

“Germany holds vast prospects for cargo bikes,” says travel expert Stefan Carsten in an interview. He anticipates Germany to sell 2 million cargo bikes by 2030.

Popular Market Categories

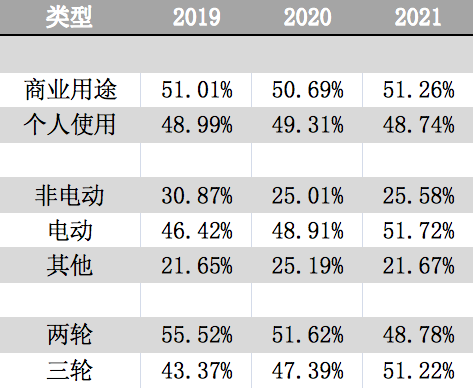

Cargo bikes are primarily classified into commercial and personal use. Personal-use cargo bikes find applications in households for daily shopping, transporting children, and goods. They are also widely utilized for urban goods transportation, with logistics giant UPS already using cargo bikes to deliver packages in over a dozen German cities. The German Bicycle Logistics Association (RLVD) estimates there are as many as 100,000 purely commercial cargo bikes on German roads.

Moreover, cargo bikes equipped with electric assist are evidently more popular due to their lower operational costs, enhanced ease of use, and longer battery life.

Increasingly Popular Shared Market

According to Bicycle Monitor 2021, 28% of respondents are inclined towards using cargo bike rental systems, more than twice the number of users willing to make a purchase (12%). This growing interest among the public for cargo bike rental systems has led to a significant increase in the supply from shared service providers. As per Cargobike.jetzt statistics, there are currently 167 cargo bike sharing service points in 137 German cities.

Government Subsidies

In Germany, commercial electric cargo bikes equipped with a Pedelec 25 drive receive subsidies of up to 2,500 euros nationwide. Several municipal subsidies are also available, such as Stuttgart offering sustainability bonuses of 800 euros for private electric cargo bikes + an additional 500 euros for car-free households after three years, or social bonuses of up to 1,500 euros; Coburg offers subsidies of up to 25% of the maximum net purchase price for cargo smart e-bikes (up to 1,500 euros), bike trailers (up to 150 euros), and cargo trailers (up to 1,000 euros); Weinsberg city offers a flat-rate subsidy of 500 euros for cargo bikes and a unified fee of 100 euros for battery replacement.

Cargo bikes, with their eco-friendly and convenient features, backed by governmental support, have emerged as a highly promising subcategory among electric micro-mobility products. They hold extensive potential in both private and commercial sectors. Germany’s rapid growth in the cargo market proves its application prospects, gradually becoming a vital component in transportation, offering a practical, eco-friendly, and low-maintenance alternative to cars and serving as the second choice for family travel.