The Japanese bicycle market ranks among the world’s largest bicycle markets. Japan’s urban environment is conducive to cycling, making bicycles extremely prevalent and a primary mode of transportation for daily commuting, shopping, and more. Moreover, Japan, being a significant country in bicycle manufacturing and sales, boasts numerous renowned bicycle brands and manufacturers.

However, after extended periods of development, the market has gradually neared saturation. The scale of the Japanese bicycle market has shrunk annually. The traditional lightweight bicycle market has contracted, while the electric bicycle market is expanding. Additionally, due to structural changes in society’s demographics, the aging market is gaining momentum.

Japanese Bicycle Market

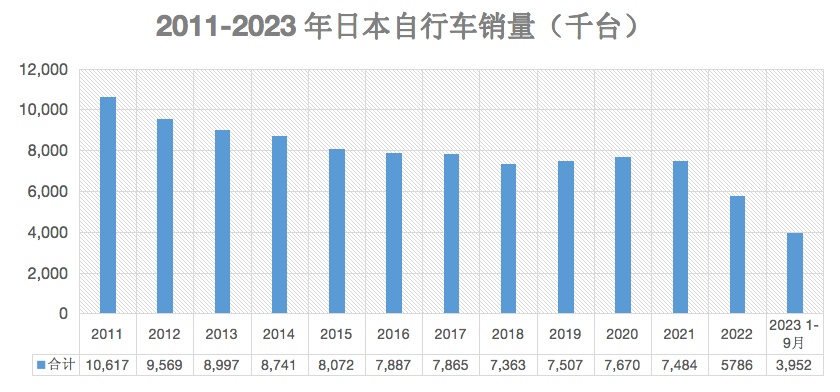

The Japanese bicycle market is sizable, but over the past decade, it has significantly shrunk. Sales declined from nearly ten million in 2011 to 7.5 million in 2018. Although sales increased during the pandemic, after three years of market recovery, there’s a notable decline in 2022, with no sign of recovery in 2023.

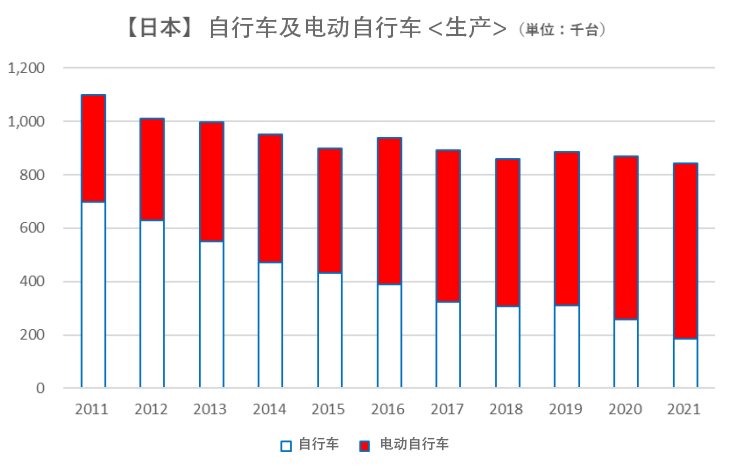

Conversely, electric bicycle sales have been rising annually at a higher growth rate, increasing from 468,000 in 2011 to 1.25 million in 2021. Moreover, in terms of production, electric bicycles account for nearly 80% of bicycle output, dominating Japan’s bicycle production market.

Despite Japan’s status as a bicycle powerhouse, its bicycle industry heavily relies on imports. China is Japan’s primary importing country for bicycles. In 2021, the main regions from which Japan imported bicycles were China, Taiwan (China), and Indonesia. For electric bicycles, the main importing regions were China, Taiwan (China), and Vietnam.

Primary Consumer Groups—Growth in the Aging Market Segment

Japan leads globally in electric bicycle penetration. Not only does the extensive history of bicycle use facilitate the market penetration of electric-assist products, but Japan’s aging population continuously drives the demand for electric-assist products.

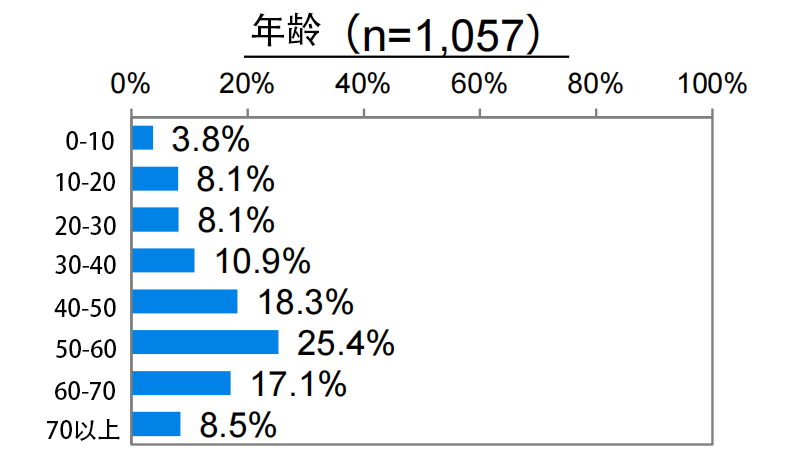

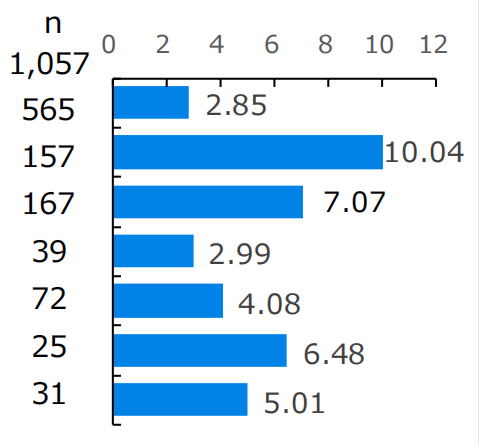

As seen in the chart, the primary users of bicycles fall within the 50-60 age range, with over 50% of bicycle users aged 50 or above. The elderly have become the primary consumer group in Japan’s bicycle market.

According to statistics, as of September 15, Japan’s population aged 65 and above numbered 36.23 million, a decrease of 10,000 compared to the same period last year. However, according to the National Institute of Population and Social Security Research in Japan’s forecast, by 2040, when the generation born during Japan’s second baby boom (1971-1974) reaches 65 years of age, Japan’s elderly population will increase to 39.28 million. At that time, the proportion of elderly people in the country’s total population will rise to 34.8%.

Due to declining physical abilities among the elderly, electric-assist products are extremely user-friendly for them, being more effortless and lightweight. The 60-and-above age group is also a significant purchaser of electric-assist bicycles, with a purchase ratio reaching 23.7%.

Primary Purchased Models

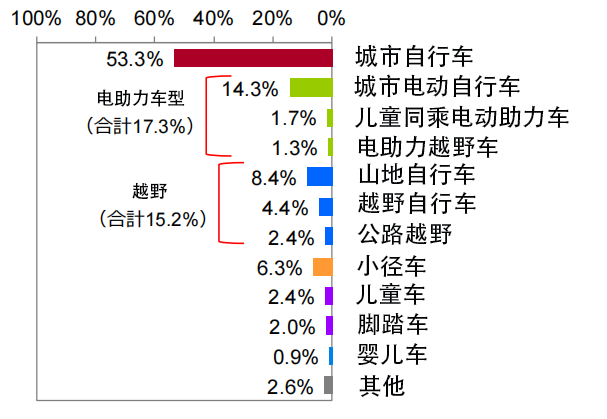

Currently, the Japanese bicycle market is still primarily dominated by lightweight urban bicycles, accounting for 53.3% of purchases. Electric-assist bike models rank second, accounting for 17.3% of overall consumption. Mountain and off-road models have a smaller share in the Japanese market. Japan has a thriving second-hand market, and many consumers choose to purchase used products.

Purchase Prices

The average purchase price for bicycles in Japan sees a majority of purchases between 20,000, 100,000, and 70,000 yen, indicating that the majority of purchases are for urban bicycles, electric-assist bikes, and off-road bikes, respectively.

Among them, lightweight bicycles are most popular within the price range of 10,000-30,000 yen. People purchasing electric-assist bikes predominantly fall within the 50,000-150,000 yen price range, indicating that the average price of electric-assist bicycles is the highest. Consumers of off-road bicycles mostly prefer models priced between 30,000-50,000 yen, while children’s bikes are mostly priced below 100,000 yen.

Primary Purchasing Purposes

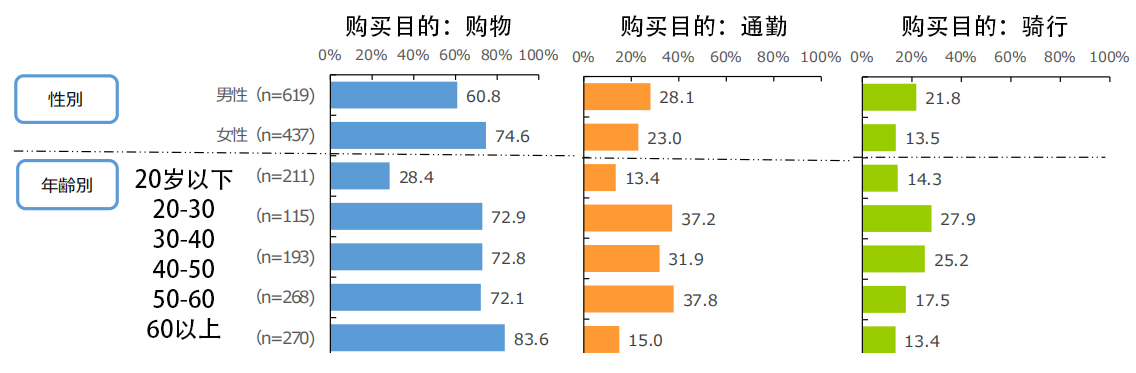

Shopping, commuting, and leisure riding constitute the primary purposes for Japanese bicycles. Among those using bicycles for shopping, the majority are females, accounting for 74% and primarily aged over 60. Commuting users are primarily working employees, with the most significant group aged between 50-60, accounting for 37.8%.

With numerous bicycle stores in Japan with large-scale operations, most people initially prefer purchasing from brand-specific stores like Giant, a professional bicycle brand. Subsequently, they might choose nearby stores, where service and pricing are significant factors attracting consumers.

Currently, the Japanese bicycle market remains significant, and consumer demand remains robust and continues to evolve. The younger generation focuses more on individuality and style, tending to buy uniquely designed bicycles. On the other hand, middle-aged and elderly consumers prioritize bicycle comfort and safety. As China stands as Japan’s primary importing country, adjustments in export strategies are necessary based on changes in Japan’s bicycle market consumer demographics and demands.